Empower Your Financial Success With Top Finance Company In Bangalore

At Amplifin Services, we understand that your financial journey is unique, and we’re here to help you navigate it with confidence and security. Our mission is to amplify your financial potential, providing you with the knowledge, guidance, and strategies needed to achieve your financial goals.

Expert Financial Guidance

Our team of experienced financial professionals is dedicated to helping you make sound financial decisions tailored to your needs and ensuring your financial security.

Customized Solutions

We believe in personalized financial solutions because we know that every client’s situation is different. Your financial plan should reflect your goals and aspirations and ensure your financial security.

Comprehensive Services

From wealth management and investment strategies to retirement planning and risk management, we offer a wide range of services to address all aspects of your financial life, ensuring security and growth.

About Us

About Us

Unlocking Financial Services and Investment Opportunities in Bengaluru

We at Amplifin Services are committed to empowering individuals and businesses through tailored financial solutions with a focus on security and growth. With a focus on integrity and expertise, we provide comprehensive services including wealth management, investment advisory, and financial planning for both individual investors and public companies. Our mission is to amplify your financial potential and secure your future success, providing you with the security necessary for peace of mind.

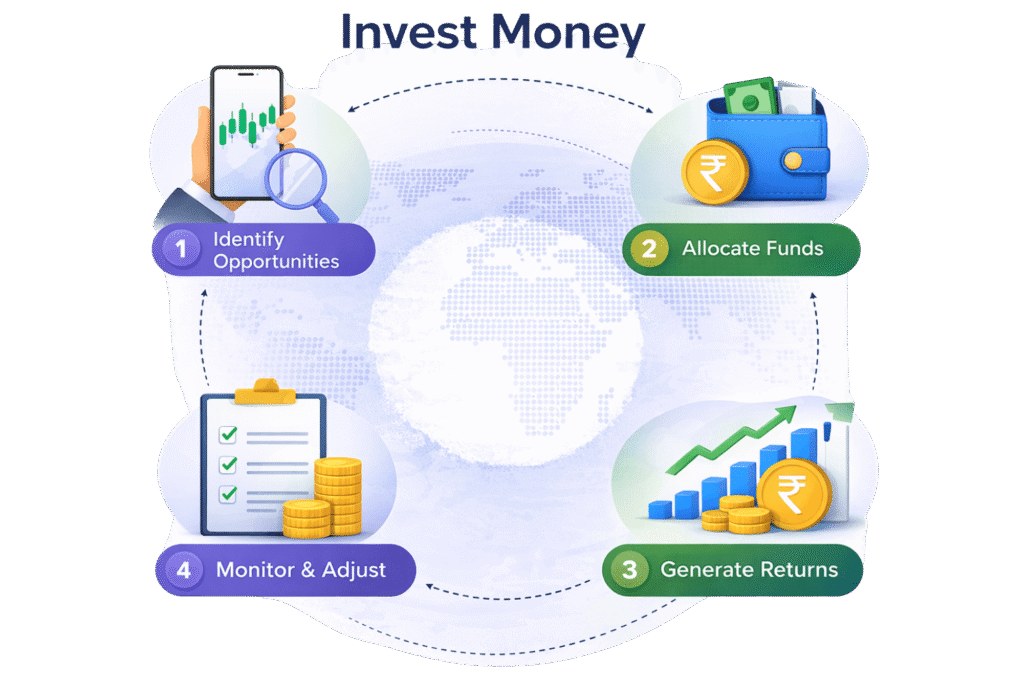

Invest your Money with Amplifin

Our Services

Financial Solutions And Services

Explore Amplifin’s comprehensive financial services tailored to your needs. From investments to wealth management, trust us for expert guidance and personalized solutions.

Life Insurance

Life insurance provides financial protection to beneficiaries in case of the policyholder's death or disability.

Health Insurance

Health insurance provides financial coverage for medical expenses, ensuring to healthcare services for individuals.

Motor Insurance

Mandatory protection for vehicles from financial loss due to accidents, theft, or damage, often required by legal regulations.

2000+

Clients

10+

Domain Experts

1000+

Insurance Claims

7+

Years Of Trust

Why Choose Us

Why Choose Us

Top Reasons To Invest with Amplifin Services:

Selecting the right insurance provider is a crucial decision that directly impacts your well-being and peace of mind.

FAQ Of Financial Services

Welcome to our FAQs section, where we address common queries to help you better understand.

What types of financial services do we offer?

We offer a comprehensive range of financial planning services including Life Insurance, Health Insurance, Motor Insurance, Mutual Funds, Loans, Credit Cards, Bank Accounts and Fixed Deposits.

What is an Insurance Policy?

An insurance policy is an agreement between you and your insurance provider for the coverage they will provide you as per the terms and conditions of the policy. The concept of insurance is simple. You pay a monthly or yearly premium to insure your life, health, home, vehicle and for other purposes like travel. In return, the insurer compensates the damages or loss you incur due the insured peril.

Why is Insurance important?

A lot of people think insurance is an unnecessary expenditure. They feel that they can tackle all kinds of emergencies with their savings. Unfortunately, the presumption and reality are vastly different. Years of savings can vanish in a minute in situations like medical emergencies.

Why is financial planning important?

Financial planning is crucial as it helps you manage your finances, prepare for the future, and achieve your financial goals. It provides a clear roadmap for saving, investing, and spending wisely.

What is a Life Insurance Policy?

A Life Insurance policy is a contract between the policyholder and the insurance provider wherein the latter promises to pay a pre-decided sum assured to the policyholder’s family in the event of the policyholder’s death during the policy period. Some life insurance policies come with an investment component as well.

Are Mutual Funds Risky?

While mutual funds do carry risk, they can be a valuable part of a diversified investment portfolio. It's important to assess your own risk tolerance, investment goals, and do thorough research or consult a financial advisor to choose the right mutual funds for your needs.

What is a Health Insurance Policy?

There are two types of Health Insurance policies. A hospitalization policy will cover your medical expenses related to hospitalization as defined in the policy. Expenses usually include in-patient hospitalization charges, ambulance, surgery, daycare procedure, hospital room bill and medical practitioners’ fees. It will also pay for specified pre- and post-hospitalization expenses. There are other health policies that pay out a pre-decided lumpsum on diagnosis of a specified illness or when a specified surgery becomes necessary. These are called benefit policies. While a hospitalization policy pays claims based on actual expenses and is renewable for life, a benefit policy pays the applicable sum assured and coverage is terminated after the claim is paid.

Protect Your Future with the Best Financial Planner in Bangalore

Ready to take the first step toward financial success? Contact Amplifin Services today for a consultation. Let us show you how we can amplify your financial potential and set you on the path to a more secure and prosperous future.

Phone

+91-9844556778

info@amplifin.in

Address

3rd Floor, Rudra Chambers, 95, 4th Main Rd, 11th Cross, Malleshwara, Bengaluru, Karnataka 560003

Book An Appointment

Join our growing community of investors

AMPLIFIN Services has been amazing to work with! They really take the time to understand your financial goals and guide you through the best insurance, mutual fund, and investment options. Super professional and easy to trust..

Smriti Pandpy

After years of trying to manage my finances on my own, I decided to work with a financial advisor. AMPLIFIN SERVICES came highly recommended, and they didn’t disappoint. They helped me understand my options for investment services, with a particular focus on mutual funds. I now have a clear wealth management plan in place, and I’m already seeing positive results in my portfolio.Because of there help today we are at such heights of our income !!!

Rao Sahab

I highly recommend AMPLIFIN SERVICES to anyone in need of a financial advisor. Their wealth management services are top-notch, and they helped me choose the right investment services, including mutual funds, to match my financial goals. I now have a clear plan in place, and I’m excited to watch my portfolio grow under their expert guidance.